A trust is an arrangement where a person or company holds assets on behalf of one or more beneficiaries. It is often used for asset protection, investment purposes, or for estate tax planning. While a trust is technically a relationship among trustees and beneficiaries, not a legal entity, they are treated as taxpayer entities for the purposes of tax administration.

Astronomical Image Processing Software Mac Logitech Harmony One Software Mac 10.10 Download Podcast App On Mac App To Stop Charging When Battery Is Full Mac Trust Tax Return Software For Mac Apps That Take Up A Lot Of Storage On Mac Mac Software Audio Controls Youtube Mac Bootcamp The Windows Support Software Has Been Saved. Use this 706 estate tax software as a standalone product or integrate it with other trust and estate products. Trust and estate management customers also buy these solutions Whether you want to automate a single task or handle the entire process, we have the solutions to help you create, execute, and maintain rock-solid trusts. H&R Block Deluxe + State Tax Software 2020 + Refund Bonus Offer Maximize Deductions H&R Block tax software helps you get your Maximum Refund, guaranteed. Deluxe + State tax software is designed to. The DT Max T3 trust tax software is perfect for Canadian tax professionals who prepare tax returns for testamentary and inter vivos trusts, including graduated rate estates. There is no simpler way to prepare Canadian and Quebec trust tax returns of any kind.

Discretionary trusts – sometimes known as family trusts in Australia – are the most commonly used trust by business owners, and are governed by specific criteria set out in a legal document, known as the trust deed. Types of assets commonly held in trusts can include:

- Property

- Shares

- Businesses

- Business premises

What are trustees and beneficiaries?

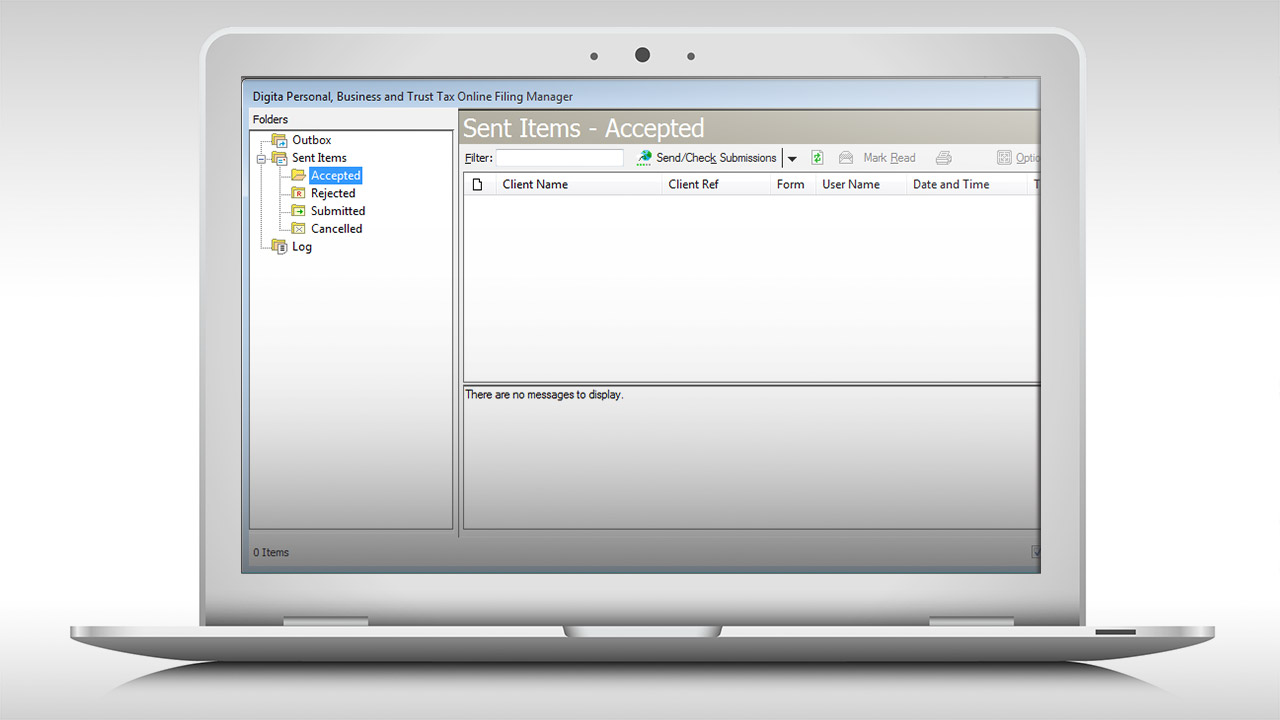

The trustee is the person or company responsible for managing the trust’s tax affairs, which includes registering the trust in the tax system, lodging trust tax returns, and paying some tax liabilities.

The beneficiary is the person – or people – who benefit from the trust arrangement. For example, in a trust set up to financially protect a family’s assets, the beneficiaries would be the family members named in the trust deed. Beneficiaries may be entitled to trust income or capital as set out in the trust deed, or at the discretion of the trustee.

Trustees and beneficiaries – and the trust itself – have separate tax obligations. These obligations depend on how the trust income is proportioned.

Trustee responsibilities

The trustee registers for the trust’s tax file number (TFN) in their capacity as trustee, which is used in filing the trust’s income tax returns. The trustee may also need to register for an Australian Business Number (ABN) if the trust is carrying on an enterprise.

Trustees must lodge a trust income tax return with the Australian Taxation Office (ATO), regardless of the trust’s net income.

A trustee themselves may be liable for tax, for which they will receive an income tax assessment as trustee. This is separate to their own individual or corporate income tax assessment. They will only need to do this if any part of the trust’s income hasn’t been apportioned to a beneficiary, in which case the trustee will be taxed on this proportionate share at the highest marginal rate.

If a beneficiary of the trust is not an Australian resident, or a minor, the trustee must withhold tax and pay it to the ATO as required.

Beneficiary responsibilities

A beneficiary is taxed based on their share of the trust’s net income that they are ‘presently entitled’ to – that is, the amount they have the right to demand payment for in that financial year.

A beneficiary will need to know their proportionate share, and include this in their individual tax return. Depending on their expected tax liability, they may also need to pay tax instalments throughout the year via the pay-as-you-go (PAYG) instalment system.

If a trust holds an asset for at least 12 months, it’s eligible for the 50% capital gains tax (CGT) concession on gains made in that financial year. This discount flows through to beneficiaries who have absolute or specific entitlement on the trust asset.

Closely held trusts: A special case

Additional withholding and reporting requirements apply for closely held trusts. A closely held trust is a trust where 20 or fewer individuals have between them – and benefit from – fixed entitlements to 75% or more of the income or capital of the trust. For tax purposes, a discretionary trust is a closely held trust.

The trustee of a closely held trust must withhold tax from payments to beneficiaries who have not provided their TFN to the trust. In addition, details of beneficiaries who are entitled to a share of the income or a tax-preferred amount (or both) must be provided to the ATO.

Furthermore, a trustee beneficiary non-disclosure tax may be payable in either of the following circumstances:

- The trustee of a closely held trust does not lodge a correct trustee beneficiary (TB) statement with the ATO within the specified period.

- A share of the net income of a closely held trust is included in the assessable income of a trustee beneficiary, and the trustee of the closely held trust becomes presently entitled to an amount that can be reasonably attributed to a part of, or the whole, untaxed part of the share.

If you’re thinking about establishing a trust, you should first seek legal and financial advice to determine the most suitable type of trust, confirm beneficiaries and set out criteria needed for the trust deed. It’s also advised you speak to professional tax advisor to understand your tax obligations.

Learn more about tax for the self-employed or if you’re running a small business here.

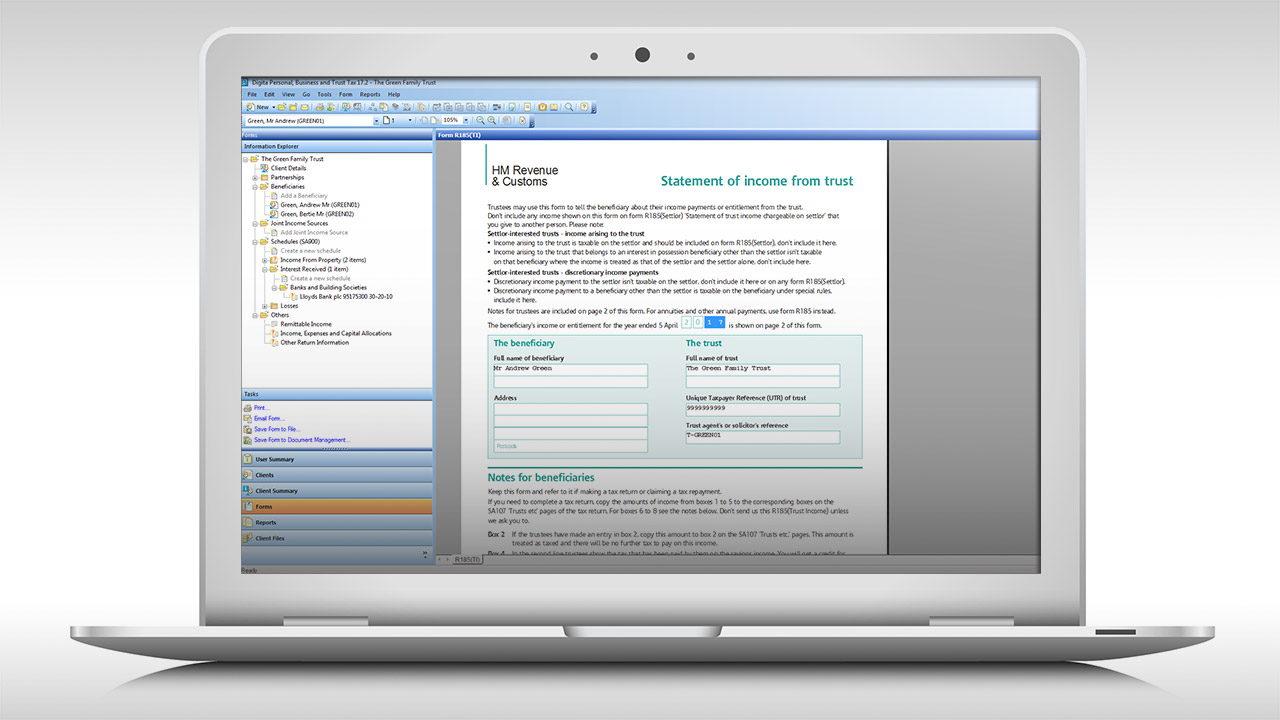

The SA107 is a supplementary tax for reporting income received from trusts, settlements, or a deceased person’s estate.

Click here to find out how to complete a SA107 tax return form.

Get StartedDon’t Let Tax Worries Distract you from your Achievements

Successful investments should be something to celebrate, and should never prompt worry over how to go about registering your resulting income with HMRC. Achieve peace of mind straight away by downloading GoSimpleTax software to calculate what you owe.

Returns on investment are unpredictable and can fluctuate dramatically, leaving you floundering when the time comes to pay the tax you owe.

Savvy investing takes a lot of mental stamina, and it’s easy to become distracted by concerns surrounding taxation. GoSimpleTax allows you to enter all income and expenditure into an easy form in real time – so you don’t lose track of your finances as time goes by.

The software also sends you notifications when there’s a chance you’ve got something wrong. This saves you from the possibility of making a mistake that could see you heavily fined, leaving you with more brain-space to focus on your investments.

Click here to find out how to complete a SA107 tax return form.

Get StartedTrust Tax Return Software For Mac Download

Why GoSimpleTax?

GoSimpleTax is the quick and easy solution to managing all of your Self Assessment information. From just £46 per year, the software can save you an average of £240 per annum on fees – if used in place of an accountant.

Tax Software For Mac Computers

There’s no need to second-guess the information as you enter it; the simple and intuitive interface includes Artificial Intelligence features that alert you when you’ve missed something or made a mistake; something that could otherwise earn you a hefty fine.

Trust Tax Return Software For Mac Osx

You don’t even need to splash out on a new device – GoSimpleTax is available on both iOS and Android. Remember to take your time as you decide whether GoSimpleTax is right for you.

Get Started